How Does the GI Bill Work for Dependents?

College isn’t cheap (we know, understatement of the century). But if you or your parents have GI Bill eligibility, there’s some good news: the GI Bill offers some of the most generous college benefits available in the U.S.

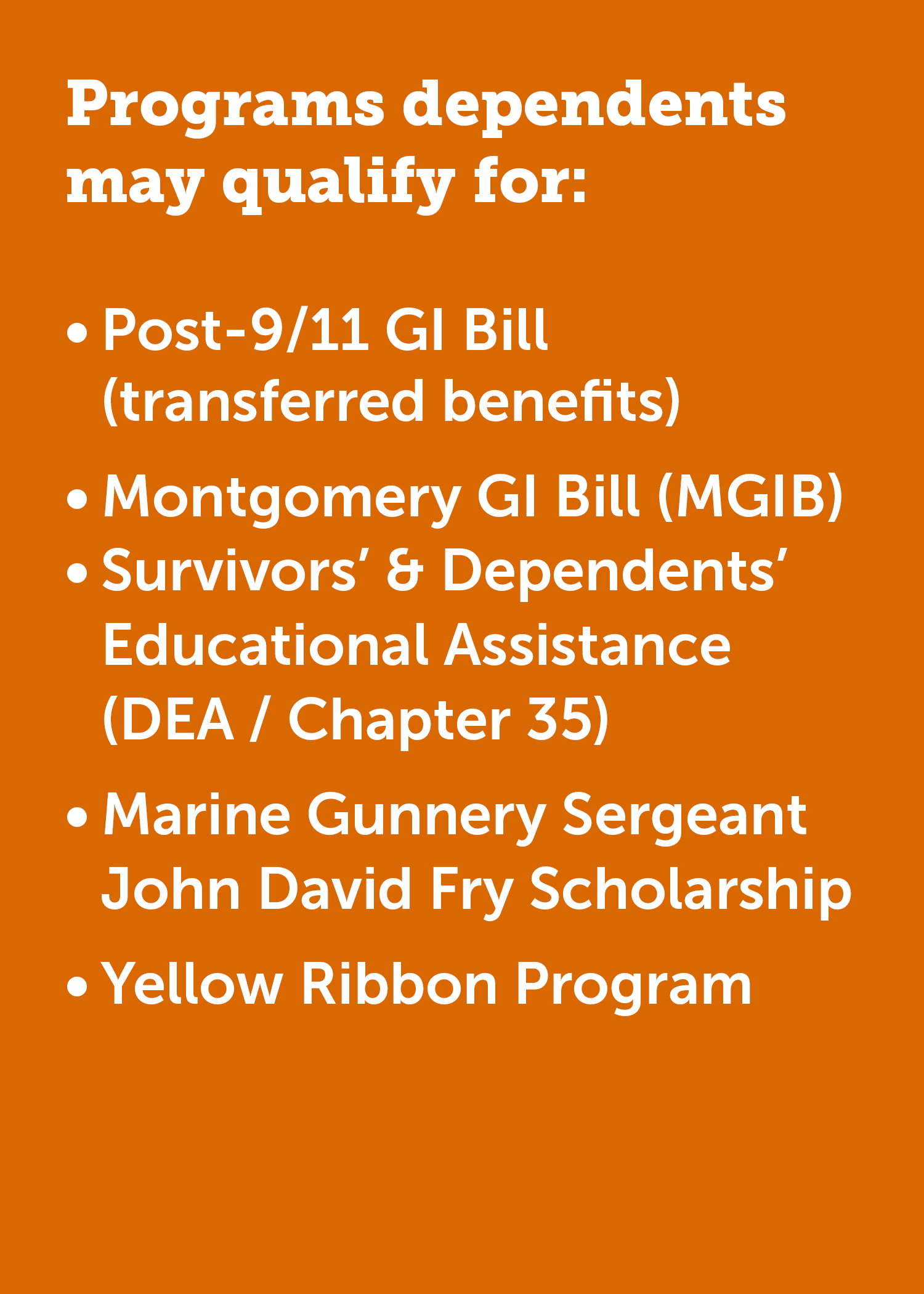

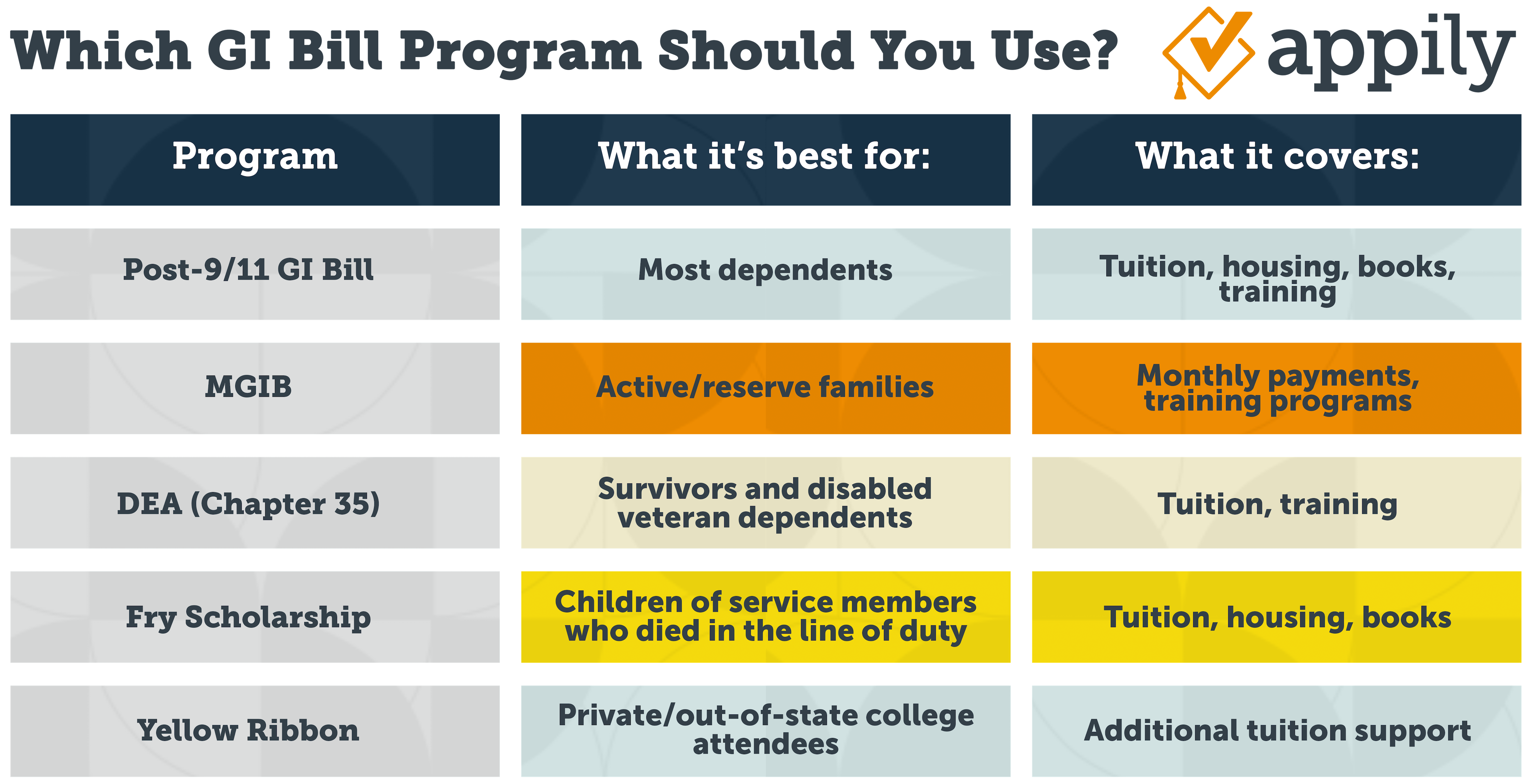

While the military doesn’t directly pay for dependents’ tuition, the Department of Veterans Affairs (VA) manages several programs, including the Post-9/11 GI Bill, the Montgomery GI Bill, and DEA benefits, that absolutely can.

If you're a military child or spouse wondering how the GI Bill works for dependents, here’s your guide to understanding which GI Bill benefits might help you head to college with a lighter financial load.

TLDR: Do Dependents Get GI Bill Benefits?

Yes. Dependents, including military children and spouses, can use GI Bill benefits if their service member transfers them, or if they qualify under Chapter 35 or the Fry Scholarship. Benefits can cover full in-state tuition, housing, books, and training programs.

GI Bill Benefits at a Glance

How the GI Bill Works for Dependents

The GI Bill supports dependents in three main ways:

- Transferred benefits (most common for children and spouses of active-duty members)

- Benefits for surviving dependents (DEA / Fry Scholarship)

- Additional tuition help (Yellow Ribbon Program, STEM Scholarship, etc.)

If your parents or spouse served, there’s a good chance you qualify for at least one of these options.

GI Bill Programs Dependents Can Use

Below is a breakdown of each major program and what it means for military families.

The Post-9/11 GI Bill

The Post-9/11 GI Bill, sometimes referred to as Chapter 33, is easily one of the most generous and widely used education benefits available.

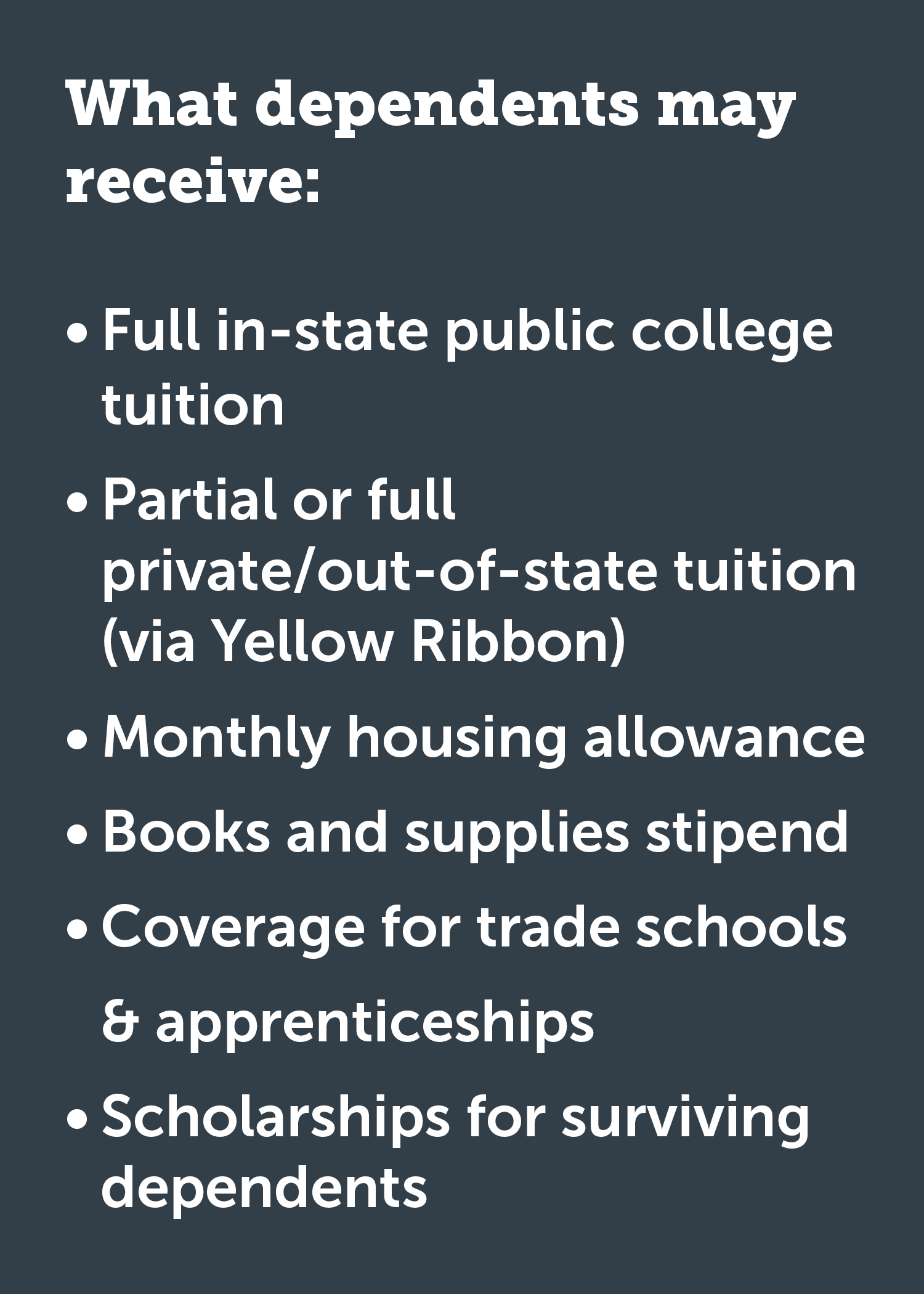

Dependents using Post-9/11 benefits may receive:

- Full in-state tuition and fees at public colleges

- Coverage for non-degree programs, trade programs, apprenticeships, on-the-job training, flight training, and more

- A monthly housing allowance

A stipend for books and supplies

Service Member Eligibility for the Post-9/11 GI Bill

A service member may qualify if they meet any of the following:

- Served at least 90 days of active duty after September 11, 2001

- Received a Purple Heart after September 11, 2001, and were honorably discharged

- Served 30 continuous days after September 11, 2001, and were honorably discharged due to a service-connected disability

If your parent or spouse meets one of these requirements, they may be able to transfer some or all of their benefits to you.

The Montgomery GI Bill

Named after Representative Gillespie V. “Sonny” Montgomery, the Montgomery GI Bill has been helping service members and veterans pay for school for decades. It comes in two versions:

- MGIB-Active Duty

- MGIB-Selected Reserve

Both versions offer up to 36 months of education benefits, which you can use for:

- College degrees

- Certificate programs

- Apprenticeships and on-the-job training

- Licensing and certification tests

- Entrepreneurship training

- Flight school

- Certain entrance exams

- Correspondence courses

How much you receive depends on your enrollment status, how long your service member served, and what you plan to study.

Keep in mind: the MGIB is different from the Post-9/11 GI Bill and usually offers lower tuition support. Many families end up leaning more toward Post-9/11 benefits because they’re more generous and more flexible — but both options are worth knowing about.

Survivors’ and Dependents’ Educational Assistance

If you’re the child or spouse of a service member who died, was captured or declared missing, or has a permanent, service-connected disability, you may qualify for the DEA program, also known as Chapter 35.

DEA benefits can help pay for school, job training, and other education programs.

The full list of eligibility requirements lives on VA.gov, and it’s worth checking if you believe you qualify.

The Marine Gunnery Sergeant John David Fry Scholarship

If your parent or spouse died in the line of duty after September 10, 2001, you may qualify for the Marine Gunnery Sergeant John David Fry Scholarship (Fry Scholarship), which offers:

- Up to 36 months of education benefits

- Tuition support (full in-state public or capped private tuition)

- A monthly housing allowance

- A books and supplies stipend

The Yellow Ribbon Program

Thinking about a private college or an out-of-state public university? The Yellow Ribbon Program might help cover costs above the GI Bill’s tuition cap.

Here’s how it works:

- The school agrees to contribute a certain amount of funding.

- The VA matches that amount, sometimes covering the full remaining tuition balance.

Only schools that participate in the program can offer these extra funds, so it’s worth checking the list. Many colleges proudly promote their Yellow Ribbon status because it significantly reduces out-of-pocket costs for military families.

You can find a Yellow Ribbon School by following this link: Find a Yellow Ribbon School.

Transferring GI Bill benefits to dependents

This is the part everyone asks about: “How do I get my parents’ GI Bill benefits?”

The transfer process can be a little confusing, so here’s the simple version:

A service member may transfer Post-9/11 benefits if they:

- Have completed at least 6 years of service,

- Agree to serve 4 more years, and

- Have their dependents enrolled in DEERS (Defense Enrollment Eligibility Reporting System).

Transfers must be requested through milConnect, and the VA handles the rest.

A parent can transfer up to 36 months of benefits. You can use them while your parent is still on active duty or after they’ve separated from service.

To use transferred benefits, you must:

- Be 18 years old or have a high school diploma (or equivalent)

- Use the benefits before turning 26

Dependents can receive the monthly housing allowance even if the service member is still on active duty.

More scholarships for military children

Even if the GI Bill isn’t an option for you, there are still scholarships reserved specifically for military dependents. Some great places to start:

- Fisher House Scholarships for Military Dependents

- List of Military Scholarships

- Scholarships.com List of Scholarships for Military Dependents

- The Ultimate Guide for Military Dependent Scholarships

- Military Affiliation Scholarships

These programs can help bridge financial gaps or support students who may not qualify for GI Bill benefits.

Resources for military dependents

Still have questions? There are more tools designed to help you navigate college costs:

Edith Nourse Rogers Science Technology Engineering Math (STEM) Scholarship

The Edith Nourse Rogers STEM Scholarship allows eligible Veterans using the Post-9/11 GI Bill or dependents using the Fry Scholarship to get added benefits. Find out if you’re eligible and how to apply by clicking the link above.

GI Bill Comparison Tool

You can use this tool to compare GI Bill benefits by school. Then, check the schools in the Appily college database to find out other essential data points, like acceptance rates and application deadlines.

Post 9/11 GI Bill Current Payment Rates

Get the current Post-9/11 GI Bill (Chapter 33) rates for August 1, 2023, to July 31, 2024. And learn about how they determine how much of the total benefit rate you can get.

Find Out if You Can Get In-State Tuition Rates

If you’re covered under a GI Bill program, you may be able to get in-state tuition rates at a public school even if you haven’t lived in the state where the school is located. Find out if you qualify for in-state tuition rates under Section 702 of the Veterans Choice Act.

Transferred Post 9/11 GI Bill Transferred Benefits

Get the current rates for transferred Post-9/11 GI Bill (Chapter 33) benefits for August 1, 2025, to July 31, 2026. And learn about how they determine your rate.

The Survivors and Dependents’ Educational Assistance (DEA) Program

This program, also known as Chapter 35, provides education and training opportunities to a child or spouse of a veteran or service member who meets specific criteria, which in part include:

- The Veteran or Service member is permanently and totally disabled due to a service-connected disability

- The Veteran or Service member died in the line of duty

- The Veteran or Service member died as a result of a service-connected disability

Make confident college decisions with Appily

Now that you’re up to date on all the benefits military children and spouses may access, it’s time to find and connect with perfect-fit colleges.

One of the easiest ways to figure that out is to take our college majors quiz. It's always free, and students tell us it's helpful for narrowing down their options.

Just click the button below to take our college major quiz!

GI Bill Frequently Asked Questions

Who is eligible to use the GI Bill as a dependent?

To use GI Bill benefits as a dependent, you must have a parent or spouse who meets VA service requirements and officially transfers benefits to you through milConnect. You must also be enrolled in DEERS, be 18 or older or have a high school diploma, and you must use the benefits before turning 26.

How long do GI Bill benefits last for dependents?

Most dependents receive up to 36 months of benefits. Children must use transferred benefits before age 26, though some programs (like Chapter 35) have slightly different time limits.

Is the GI Bill the same for children and spouses?

Dependents (children and spouses) can receive the same GI Bill benefits, but children must use transferred benefits before age 26, while spouses may have more flexible timelines depending on the program.

Do military kids get free college?

Military children can receive free or significantly reduced college tuition if they qualify for transferred Post-9/11 GI Bill benefits, the Fry Scholarship, or DEA (Chapter 35). At public universities, the Post-9/11 GI Bill often covers 100% of in-state tuition, and the Yellow Ribbon Program can cover private or out-of-state tuition that exceeds the base GI Bill cap.